Metamorphosis from a start-up to a unicorn

Tips for entrepreneurs

Hailed as the most innovative University in Hong Kong by ‘Reuters Top 75: Asia’s Most Innovative Universities’ for four consecutive years since 2016, CUHK has been relentless in nurturing talents and translating research excellence into tangible innovation. To date, CUHK faculty members and alumni have grown four unicorns (start-ups valued over US$1 billion).

The latest one is Smartmore Co. Ltd. which specialises in smart manufacturing optimization and automation. The company was founded in late 2019 by CUHK’s Institute of Electrical and Electronics Engineers (IEEE) fellow Professor Jia Jiaya, a distinguished artificial intelligence (AI) scholar in computer vision. AI and computer vision technologies have ushered the manufacturing sector into a new era of smart industry. It took Smartmore only 18 months to morph into a unicorn after its inception.

Whether a start-up could survive and transform into a unicorn would largely depend on its financing and downstream commercialization activities. To catalyze commercialization activities and instill an innovative culture across the University, CUHK’s Office of Innovation and Enterprise (OIE) and the Hong Kong Science and Technology Parks Corporation (HKSTP) co-organised the CUHK-HKSTP Investment Day on 13 May. The event comprises a public webinar and a company pitching session. In the webinar, Ambassador George Hara and CUHK alumnus Mr Oscar Hui gave keynote speeches on investment landscape, future trends in healthcare and fundraising management.

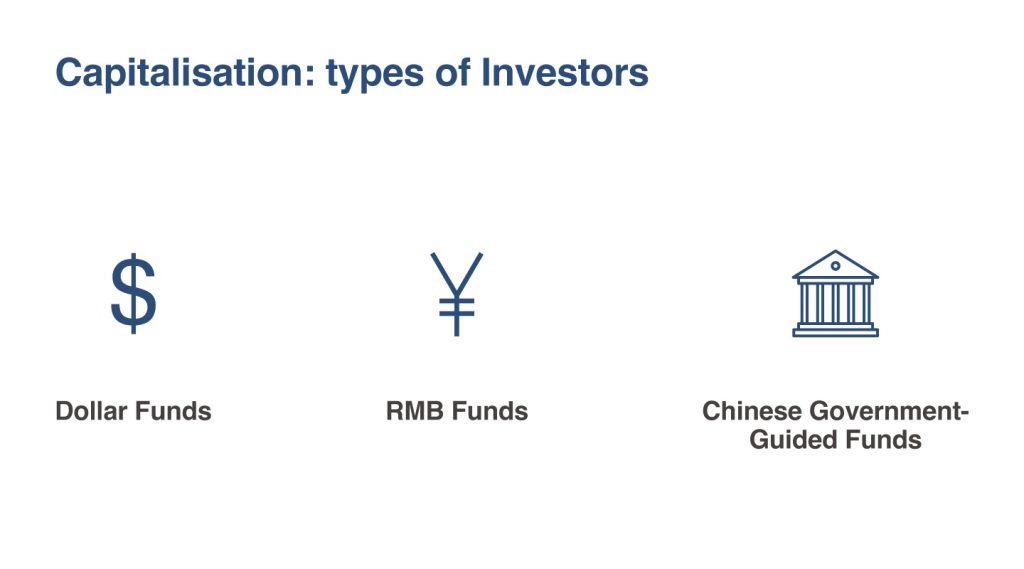

With 15 years of experience in equity capital, venture capital and technology transfer, Mr. Hui, Head of Strategy, Investment and Financing of Smartmore, shared on ‘Investing for Commercial Success as an Emerging Company’ and gave start-up founders some tips for success from the perspectives of investors and industry players.

During their humble beginnings, start-ups have to prove the value of their business models to raise seed capital. ‘Investors will evaluate your plans based on the pain points identified in your business solutions and the products and services offered to your target customers. You will need to justify your business models and revenue return,’ Mr Hui advised.

He introduced the concept of ‘total addressable market (TAM)’ to the audience. It refers to the entire revenue opportunity, which is an estimate of the amount of sales that one firm would have if it had 100% market share. A TAM analysis can help start-ups identify opportunities and understand the landscape of market competition. Venture investors use TAM to estimate growth potential, and venture capital firms are unlikely to invest in start-ups without a sufficiently large TAM.

Mr Hui listed four factors for business success: revenue scale, revenue growth, profitability and business model. Specifically for profitability, he noted that companies should aim to achieve more than 20% of the operating margin. ‘We have reviewed 400 tech companies, and only 6% have met all the criteria. A better understanding of the investors’ expectations helps you define and achieve your business goals.’

As the customer base grows, start-ups tend to expand their new offices, hire more employees and some even plan for an initial public offering (IPO). Hong Kong is a popular IPO destination for biotech companies. ‘Hong Kong has renowned universities and research institutions such as CUHK and HKSTP. InnoHK launched in 2021 is an evidence of the government’s staunch support to R&D,’ said Ambassador George Hara. He is the founder of DEFTA Partners, a venture capital firm that has invested in more than 100 companies in the US, the UK, Israel, Bangladesh and Japan, including the first gene therapy company Viagene. He founded DEFTA Healthcare Technologies in 2016 to fund and grow technology companies that aspire people to live a healthy life until their final moment.

He serves as Senior Advisor to the Cabinet Office of the Prime Minister of Japan. Under his vision of Public Interest Capitalism, and through his public duties to his country, he strives to build a framework to commercialise and industrialise new technologies and to rebuild the country’s fiscal health while reducing the tax rates and increasing tax revenues at the same time.

‘One factor to achieve the vision is to pursue policy innovation. The Japanese government took my advice and revised its pharmaceutical law in 2014 to enable conditional early approval for drugs after completing Phase II clinical trials. It usually takes six to ten years to approve a new drug. The holy grail is for patients to use new drugs much earlier, without waiting for the full evaluation of a patient group in a controlled study.’

More than 200 participants gained insight from the talks. An onsite survey reveals that they were satisfied with the event and would like to have similar events organised regularly. In the following company pitching session, six CUHK and HKSTP affiliated companies, mostly in the biotechnology area with backgrounds in AI and data analytics, pitched to a panel of 12 healthcare and technology investors. In addition to possible investment opportunities, the participating companies received advice and mentorship which will be crucial for their ongoing business development.

‘CUHK has been pushing hard to promote entrepreneurship and innovation. This is just the beginning and we will be organising more investment days in the future for companies of different specialties,’ said CUHK’s Associate Vice-President (Innovation and Enterprise) Professor Daniel Lee. ‘OIE strives to promote research innovation, start-up activities and corporate partnerships, with a specific objective to engage with multiple stakeholders in a concerted effort to accelerate the translation of CUHK’s research into commercial products and services with societal impact.’

By Jenny Lau